Why we backed Zoe Financial: Solving the Growth Paradox in the RIA Market

By: Sasank Chary, Andy Greos, Brad Tatz & Ian Steren

At Sageview, we have long believed in the structural tailwinds behind independent advice. Our history includes investments across the wealth management stack — including RIAs themselves. That experience has shaped our view of the space and deepened our conviction in the opportunity for the next generation of wealth platforms. It’s through this lens that we’re thrilled to announce our lead investment in Zoe Financial’s $30 million Series B.

From early in our discussions with Zoe’s founder Andres Garcia-Amaya, it was clear to us Zoe is tackling two of the most persistent challenges facing the $6 trillion RIA market — growth and efficiency. Zoe is uniquely well-positioned to enable RIAs to scale their businesses with a modern, client-centric experience. We are excited to partner with Andres and the whole Zoe team as they take the next step in their journey.

The RIA Channel is Massive

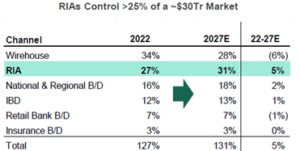

Independent RIAs in the U.S. now manage over $6 trillion in assets, roughly one-third of all advised retail assets [source: Cerulli, 2023]. Growth is outpacing all other channels, including wirehouses and broker-dealers.

Chart: The channel shift underway in wealth management. Source: Cerulli

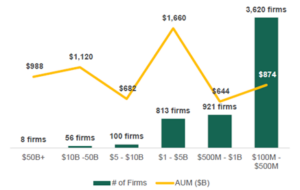

The market is also highly fragmented, with over 5,500 firms. While there is a consolidation trend, there is consistent replenishment of new firms as advisors “go independent,” leaving traditional firms for the flexibility, more control, and personalized client service that the independent RIA model provides.

Chart: Source: SEC data filtered for RIAs offering planning and focused on individuals/HNW

RIAs operate with a keen focus on client service. By definition, it is a high-touch business. They take pride in their fiduciary duty, centering their work on client interests, personalized planning, and long-term trust.

However, RIAs run into two consistent problems: scaling an organic growth function, and efficiently servicing those clients once onboarded. Our enthusiasm for Zoe is rooted in their duel-pronged approach to tackling both fundamental challenges.

Driving organic growth is the biggest challenge for advisors

In a recent survey, 55% of advisors identified “new client acquisition” as their greatest challenge [source: Cerulli, 2023]. Most RIAs rely on customer referrals, COIs (lawyers, accountants, etc.), and seminars to drive growth. Few have succeeded in creating a scalable lead generation, often relying on word of mouth. The largest custodians (Schwab and Fidelity) have robust referral programs, which are highly coveted relationships for RIAs but only made available to select firms. Meanwhile, demand from consumers continues to shift online, but few RIAs are equipped with the digital acquisition tools, skills, or resources needed to meet it. Ficomm’s 2024 Financial Advisor Growth Marketing study found that 57% of people under 44 hire their advisor through digital marketing. Without a scalable digital acquisition strategy, most RIAs are structurally misaligned with where future demand is coming from.

The Technology and Small Account Problem

RIAs operate a high-touch model originally designed around larger accounts and spend significant time on onboarding, compliance, trading, account maintenance, and reporting. To deliver this, they often rely on a patchwork of legacy technology and workflows, leading to inefficiencies and frustration.

This becomes even more problematic when scaling this delivery model to smaller accounts, making it difficult to serve this constituency profitably using the same infrastructure. Many firms face a classic 80/20 imbalance: 80% of accounts generate just 20% of revenue yet demand nearly equal servicing effort as larger clients.

The result is smaller clients — often the mass affluent or HENRYs (High Earners, Not Rich Yet) — are underserved. These clients are either turned away or placed into low-touch service tiers, not because of lack of need, but because the economics don’t pencil out under traditional service models.

Zoe creates synergy across both problems.

Zoe’s client referral network acts as a powerful engine for organic growth by connecting RIAs with qualified, high-intent investors who are actively seeking fiduciary advice. Once part of the Zoe Referral Network, advisors receive scheduled appointments with highly curated leads. This streamlines the often time-consuming and expensive process of lead generation, allowing advisors to focus on what they do best: building relationships and providing great financial advice. And clients get paired with best-fit advisors based on their own needs and goals, not just asset size. Importantly, Zoe only gets paid once a client signs, creating real alignment with RIAs.

Complementing the referral network, the Zoe Wealth Platform offers end-to-end portfolio management with a fully digital, all-in-one platform for servicing clients. The platform combines all of the capabilities typically found in multiple vendors: custody, digital account opening and funding, customizable portfolios, direct indexing and fractional trading, automated rebalancing, reporting, billing, cashiering, and a client portal. In our conversations, advisors consistently spoke to the added efficiencies the Zoe Wealth Platform creates, helping them more effectively serve their clients and scale their own businesses.

This powerful combination of client acquisition and operational efficiency positions Zoe as a transformative partner for independent RIAs. Zoe can provide a comprehensive framework for RIAs to scale, enhance profitability, and deliver a superior client experience.

Final Thought: Expanding Access

At its heart, Zoe is about access and alignment.

Too many consumers are stuck in a maze of bad advice — commission-driven, opaque, or unavailable altogether. Zoe changes that. It gives people:

- A curated path to a fiduciary advisor who actually fits their needs

- The transparent, digital-first experience they seek in all aspects of their life

- A model that puts advice first

We couldn’t be more excited to partner with Andres Garcia-Amaya and the team at Zoe as they build the infrastructure for the next generation of financial advice.

Interested in learning more about Zoe? Visit zoefin.com

Want to connect about the RIA space or fintech infrastructure? We’d love to hear from you.