User Research? Survey says: Power to the participant!

By Mike McClure, Caitlin Vorlicek, & Michael Marcus

In December, we were thrilled to announce our $27.5m Series B investment in User Interviews (UI), the leading provider of user research, participant recruitment, and management software. UI is tackling a critical pain point for user researchers, disrupting legacy methods, and delivering a compelling ROI to a rapidly growing number of customers.

User research has been a hot topic of late, and for good reason. Demand for user research has skyrocketed, “user experience researcher” has become one of the fastest-growing job titles in our country, many new companies have been formed and funded to address researchers’ needs, and several large transactions have made headlines. After extensive work in the user research ecosystem, we learned the market is large, fragmented, growing rapidly, and has become essential for many businesses. We also learned this market could be segmented into a few different categories, and one of the most mission-critical areas is participant recruitment and management.

Trends Driving User Research

User research is the act of studying target users to better understand their needs and motivations through a variety of research methodologies. It is used to make better product development decisions by understanding how people interact with products and evaluating whether those products meet their needs. During our diligence, we identified at least three long-term secular trends driving growth in user research:

- The proliferation of digital experiences. Whether we’re communicating with family or colleagues, using software at work, shopping, banking, or simply learning, people today tend to gravitate toward digital applications to manage their lives. As a result, nearly every company and government has been forced to build digital products to engage and educate customers. The statistics are staggering – app downloads surpassed 250 billion in 2022, up 80% from 2016, while the number of websites has more than doubled in the last decade to nearly 2 billion. Much of this growth has been driven by companies building apps and websites to meet customers and prospects where they are – online. Builders of these digital products leverage user research to better understand what to build and how to refine it.

- Growth in agile software development. Companies today release new versions of digital products more frequently than ever before. The adoption of agile software development has increased by nearly 90% since 2002 to more than 70% of companies today, and these teams are getting products to market 50% faster than non-agile teams. This trend is forcing product development teams to conduct more frequent user research to ensure their efforts deliver value to customers. Gone are the days of exhaustive user studies conducted once every five to ten years. Product development teams today demand access to more frequent, less cumbersome, and less expensive user feedback to support their agile processes.

- Adoption of product-led growth business models. The software industry shifted in the early 2000s from on-premise, license-maintenance business models to cloud-based, SaaS business models. Users no longer needed to make long-term purchase decisions with large upfront costs – they could try, pay as they went, and switch to a competitor at their leisure. This growth of SaaS solutions placed utmost importance on the customer experience, leading to the prioritization of customer success teams and the advent of product-led-growth (“PLG”). Today, more than 50% of companies have a PLG strategy in place, and more than 90% are planning to increase their investment in PLG, according to a recent Gainsight Survey (link below). User research is vital to a successful PLG business model, as it is the only way to fully understand how to build and improve these largely self-serve features and products.

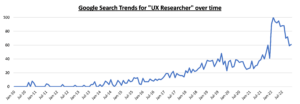

We’re also seeing these trends play out in the labor market – this year LinkedIn listed “User Experience Researcher” as the #8 fastest-growing role in the US, while Google search trends for “UX Researcher” have exploded since the mid-2000s.

The User Research Landscape

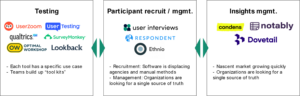

As the Sageview team learned through our own research, there are many different ways to conduct user research: from diary studies to A/B testing to surveys, focus groups, and moderated and unmoderated interviews. Most researchers leverage several methodologies at once and use numerous testing tools – often one or more tools per methodology. The most common methodology is the moderated user interview, and the most used tools to conduct this type of research are Zoom and Google Meet. Nearly 90% of people who do research leverage moderated user interviews.

But the testing platform is only one part of the solution. A major pain point in user research is the cumbersome process of finding the right participants in a timely manner. With the pace of innovation and scale of research today, legacy means of participant recruiting – typically manual or through an agency – simply don’t cut it. Researchers need a faster, cheaper way to access quality participants. While a few testing tools do provide their own panels, participants from these panels typically cannot be used with other testing tools. These companies also often struggle to provide quality participants at scale, given their primary focus is on the testing tool itself. Recruiting and panel management have become a mission-critical layer of the researcher’s tech stack. Innovative companies like UI enable customers to access better participants faster and more cheaply than ever before.

The insights management layer is the last and most nascent layer of the research tech stack. While some testing tools provide analytic capabilities, companies are increasingly searching for the ability to organize and analyze research across tools and methodologies. Emerging vendors are beginning to address this need.

A Sample of Solutions:

User Interviews

User Interviews sits at the mission-critical layer of conducting research at scale: recruiting and managing participants. UI’s recruit platform is best-in-class: its median time to fill a study is just one hour, and they don’t sacrifice quality to get there. In our diligence, we leveraged UI to conduct a survey, and the results were clear: When asked to rank 8 different tools by panel quality, with 1 being the best and 8 being the worst, UI won by a wide margin, with an average ranking of 1.1 out of 8 (n=19). But UI’s solution doesn’t stop there. Many organizations need a way to conduct research at scale across many teams or geographies, and current approaches to participant management are falling short from a compliance and workflow perspective. UI’s “Research Hub” tool is purpose-built to solve this need, helping customers delineate between user types and contact them appropriately across studies, all while keeping tabs on gifting limits and monitoring PII in a compliant manner. By focusing exclusively on recruiting and participant management, UI eliminates a critical bottleneck for researchers and allows them to spend more time focusing on the results’ implications instead of the process’s challenges.

Partnering with User Interviews

Though we can’t predict what methods will “win” in user research, we believe the volume of studies will only increase. The demand for compliant participant recruitment and management will keep pace. Basel and his team experienced this need years ago and have done an exceptional job solving a clear market need while evangelizing the user research market through excellent content. As digital experiences continue to dominate our work and personal lives, supporting UI ultimately benefits us all by improving the pace and quality of digital innovation. We are thrilled to leverage Sageview’s many resources to help Basel and team build a category-defining business in the user research market!

Resources

https://www.techrepublic.com/article/report-saas-companies-product-led-growth/

https://firstsiteguide.com/how-many-websites/

https://www.statista.com/statistics/271644/worldwide-free-and-paid-mobile-app-store-downloads/

https://www.zippia.com/advice/agile-statistics/